If you’re like most people in the Tampa Bay area, you’ll be glad when tax day – Monday April 18 - is finally behind us. Hopefully, you’ll be receiving a nice refund. If you are, why not put it towards a new swimming pool or for refurbishing your existing pool?

If you’re like most people in the Tampa Bay area, you’ll be glad when tax day – Monday April 18 - is finally behind us. Hopefully, you’ll be receiving a nice refund. If you are, why not put it towards a new swimming pool or for refurbishing your existing pool?

It can be difficult to save for new pool construction or pool refurbishing, but if you think about it, your tax refund is the result of a year of saving. You automatically had extra money taken out of your paycheck each pay period, and now the U.S. government is sending it back to you. Because the IRS doesn’t pay interest, it's not the best way to save, but it helped you save none the less.

Now you can invest that cash in your pool. And yes, it is an investment in many ways…

1) Invest in your home. A new or resurfaced pool will increase the value of your home.

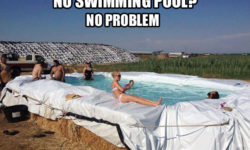

2) Invest in your family. Swimming and playing in the pool is an awesome way for your family to spend time together. If you don’t have children at home, it’s a great setting for some alone time with your spouse or fun with grand kids or other family.

3) Invest in your friendships. A pool and outdoor kitchen area are great settings for entertaining. Invite your friends over. Get together with extended family. Even host events for the church, school or community group you’re a part of.

4) Invest in yourself. Most of us live very busy lives. It’s important to slow down, relax, and reflect. A beautiful, peaceful outdoor setting can help you do that.

If you are interested in investing your tax refund in a new pool or remodeling your current pool, please contact us at Grand Vista Pools today.